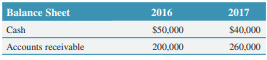

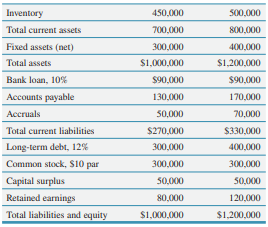

The following are balance sheets for the Genatron Manufacturing Corporation for the years 2016….

The following are balance sheets for the Genatron Manufacturing Corporation for the years 2016 and 2017:

a. Calculate the WACC based on book value weights. Assume an after-tax cost of new debt of 8.63 percent and a cost of common equity of 16.5 percent.

b. The current market value of Genatron’s long-term debt is $350,000. The common stock price is $20 per share and 30,000 shares are outstanding. Calculate the WACC using market value weights and the component capital costs in (a).

c. Recalculate the WACC based on book value and market value weights assuming the before-tax cost of debt will be 18 percent, the company is in the 40 percent income tax bracket, and the after-tax cost of common equity capital is 21 percent.

The following are balance sheets for the Genatron Manufacturing Corporation for the years 2016…