1. Franklin, Jefferson, and Washington formed the Independence Partnership (a calendar-year-end….

1. Franklin, Jefferson, and Washington formed the Independence Partnership

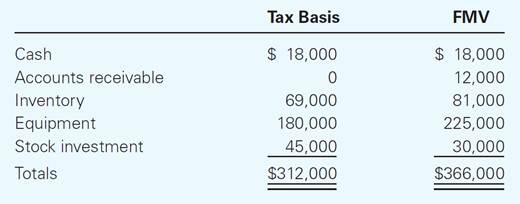

(a calendar-year-end entity) by contributing cash 10 years ago. Each partner owns an equal interest in the partnership. Franklin, Jefferson, and Washington each have an outside basis in his partnership interest of $104,000. On January 1 of the current year, Franklin sells his partnership interest to Adams for a cash payment of $122,000. The partnership has the following assets and no liabilities as of the sale date:

LO 21-1

The equipment was purchased for $240,000, and the partnership has taken $60,000 of depreciation. The stock was purchased seven years ago.

a) What is Franklin’s overall gain or loss on the sale of his partnership interest?

b) What is the character of Franklin’s gain or loss?

1. Franklin, Jefferson, and Washington formed the Independence Partnership (a calendar-year-end…